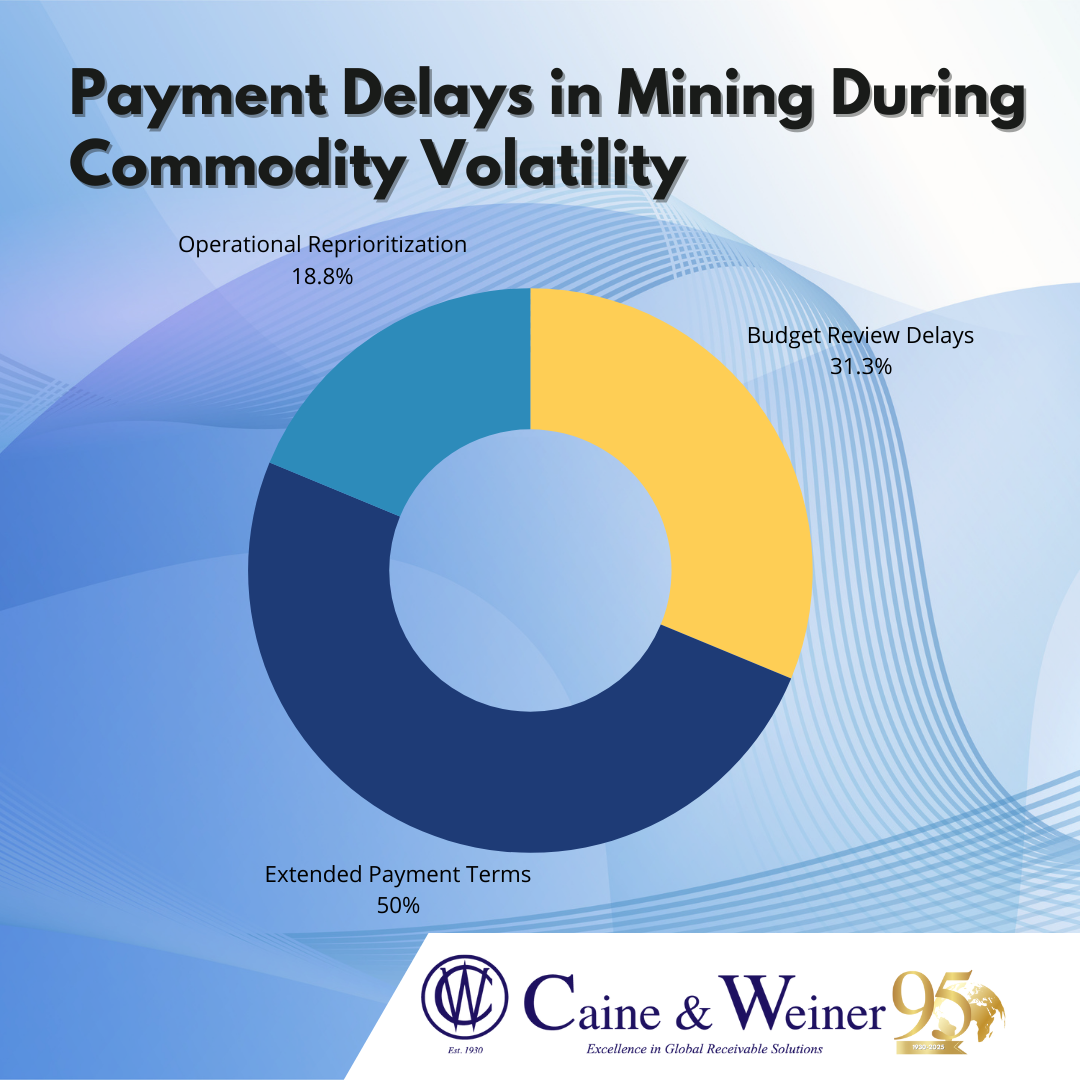

Payment behavior in the mining industry doesn’t follow invoices—it follows the commodity market. When copper, lithium, coal, or nickel prices swing, the entire financial structure of mining companies shifts with them. Production priorities change. Capital allocation changes. Cash reserves get reassigned to critical operations. And vendors feel the effects—fast. Industry analytics reveal a clear pattern: When commodity volatility spikes, mining …

When Fast Growth Breaks the Workflow: Why SaaS Companies Struggle with Payment Drift

In SaaS, growth is celebrated—MRR climbs, new users flood in, product updates ship weekly, and expansion becomes the norm. But beneath the excitement of scaling lies a less glamorous truth: Fast scaling = fast chaos. And nowhere is this more visible than in accounts receivable. Recent industry data shows a surprising trend: SaaS companies experience a 40% increase in missed …

When Claims Surge, Payments Slow: The Hidden Workflow Bottlenecks Inside Insurance AP

The insurance industry is built on preparedness. Policies. Procedures. Protocols. Claims. Everything has a flow—until it doesn’t. Every year, insurers face periods when claims spike sharply. Sometimes it’s seasonal (storms, wildfires, weather events). Sometimes it’s market-driven (rate changes, policy shifts). Sometimes it’s internal (staffing transitions, system upgrades). When those claim cycles hit, something happens behind the scenes that most vendors …

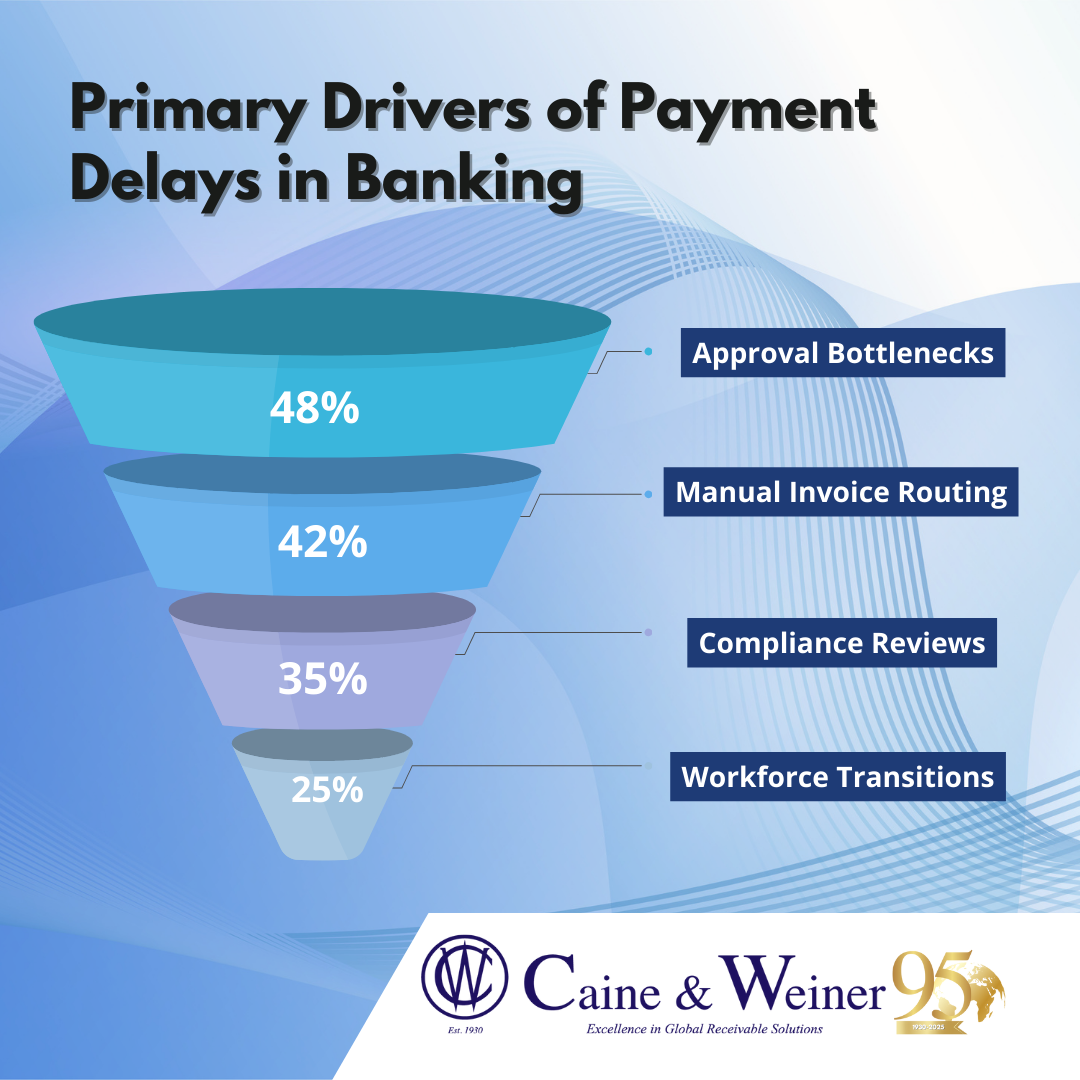

When Banks Fall Behind: Why Payment Delays Aren’t About Cash—They’re About Workflow

On the surface, the banking industry appears steady, structured, and predictable. Money moves in, money moves out, balances reconcile, and invoices get paid. But talk to any vendor working with a financial institution today, and a different story emerges—one that begins not with dollars, but with delays. It often starts with a familiar message: “Still in approval.” “Compliance is reviewing …

From Boom to Bottleneck: How Mining Companies Can Maintain Cash Flow Through Market Volatility

For years, the supplier had enjoyed a reliable payment rhythm from one of the largest mining operations in their region. In good years, invoices were paid early. In average years, they were paid on time. Even during occasional dips in demand, payments never drifted more than a week or two. But this time was different. Invoices that once cleared in …

The “Too Busy to Pay” Problem: Why HR Turnover Is Quietly Creating More Slow-Pay Accounts

It always starts with one email. “Sorry for the delay—we’re onboarding a new AP clerk.” “We’re short-staffed this month.” “Our HR team is transitioning roles.” Individually, these messages feel harmless. But when they start showing up month after month, on invoice after invoice, they reveal something deeper—even dangerous—for your accounts receivable. Across service industries, e-commerce companies, and even corporate offices, …

The Vendor Who Got Paid Last: How Priority Shifts Signal Deeper Financial Trouble

Most credit teams focus on when a customer pays. But very few pay attention to a far more predictive metric: who the customer pays before you. In industries with tight and unpredictable cash cycles—retail, distribution, transportation, and mining—this oversight can mean the difference between timely resolution and ending up in a bankruptcy queue. This is the story of a national …

When Automation Isn’t Enough: The Hidden Human Gaps Costing Tech Companies Millions

No one expected the warning signs to come from the finance intern. The SaaS company—growing at a breakneck 40% year-over-year—had automated nearly every aspect of its revenue cycle. Invoices were sent instantly. Payment reminders were triggered by clean API logic. Escalations followed strict decision-tree workflows. “Everything is automated,” the CFO proudly shared. Except the problem wasn’t in the automation. It …

The Talent Drought: Why Getting Hired in 2025 Feels Hard—And What It Means for Industries That Need Workers the Most

Maria’s Story: From Laid Off to “Looking for Opportunities” Maria didn’t expect to be laid off. She worked five years at a software company, top ratings, loyal team player. Then came the email: “Restructuring. Position eliminated.” She wasn’t alone. In 2024–2025, more than 540,000 workers across tech, finance, and retail faced layoffs. Maria applied for 126 jobs. Heard back from …

Fortress or Fault Line? What Bankers Are Really Facing in the Age of CRE Stress and Consumer Credit Shifts

The Call Every Banker Remembers It usually happens on a Wednesday. A loan officer opens their inbox to see a message flagged urgent: “Tenant filed for bankruptcy. Cash flow disruption expected. Requesting modification.” That single line represents exactly what banks fear—unpredictability. In 2024–2025, those emails have become a lot more common. Office occupancy hasn’t recovered. Leasing debt is aging. Large …