On Monday, the numbers look incredible. The dashboard shows record sign-ups. ARR is climbing. The sales team just closed two enterprise logos that will look great on the next investor slide. Product is shipping faster than planned. Everything says growth. But by Thursday afternoon, finance sees something different. Invoices that normally clear in 30 days are still open at 42. …

Commodity Volatility Hits Cash Flow Before the Balance Sheet

At first, nothing looks wrong. Production is steady. Trucks are moving. Equipment is running. Contracts are active. The quarter’s output targets are still intact. On paper, the business looks healthy. Then a supplier notices something small. An invoice that normally clears in 30 days is still open at 38. Another stretches to 45. A third sits quietly past 60. No …

When Banks Slow Payments, Liquidity Feels It First

At 9:00 a.m., the dashboard looks normal. Cash positions are within target. Capital ratios are intact. Forecasts match expectations down to the decimal. On paper, everything says the institution is healthy. By 9:07 a.m., a treasury analyst flags something small: three commercial clients haven’t paid on schedule. Nothing dramatic—just a few days late. No alarms go off. No emergency meetings. …

Why Consumer Receivables Deteriorate Faster Than You Think

On Monday, the balance looks fine. A customer makes a purchase. The invoice goes out. Everything sits neatly in the 0–30 day bucket, just like it should. By Friday, life happens. A car repair. A medical bill. A rent increase. The payment gets postponed—not rejected, not disputed, just delayed. Harmless, it seems. But in consumer receivables, that small delay is …

From ARR to AR: When Subscription Revenue Gets Stuck

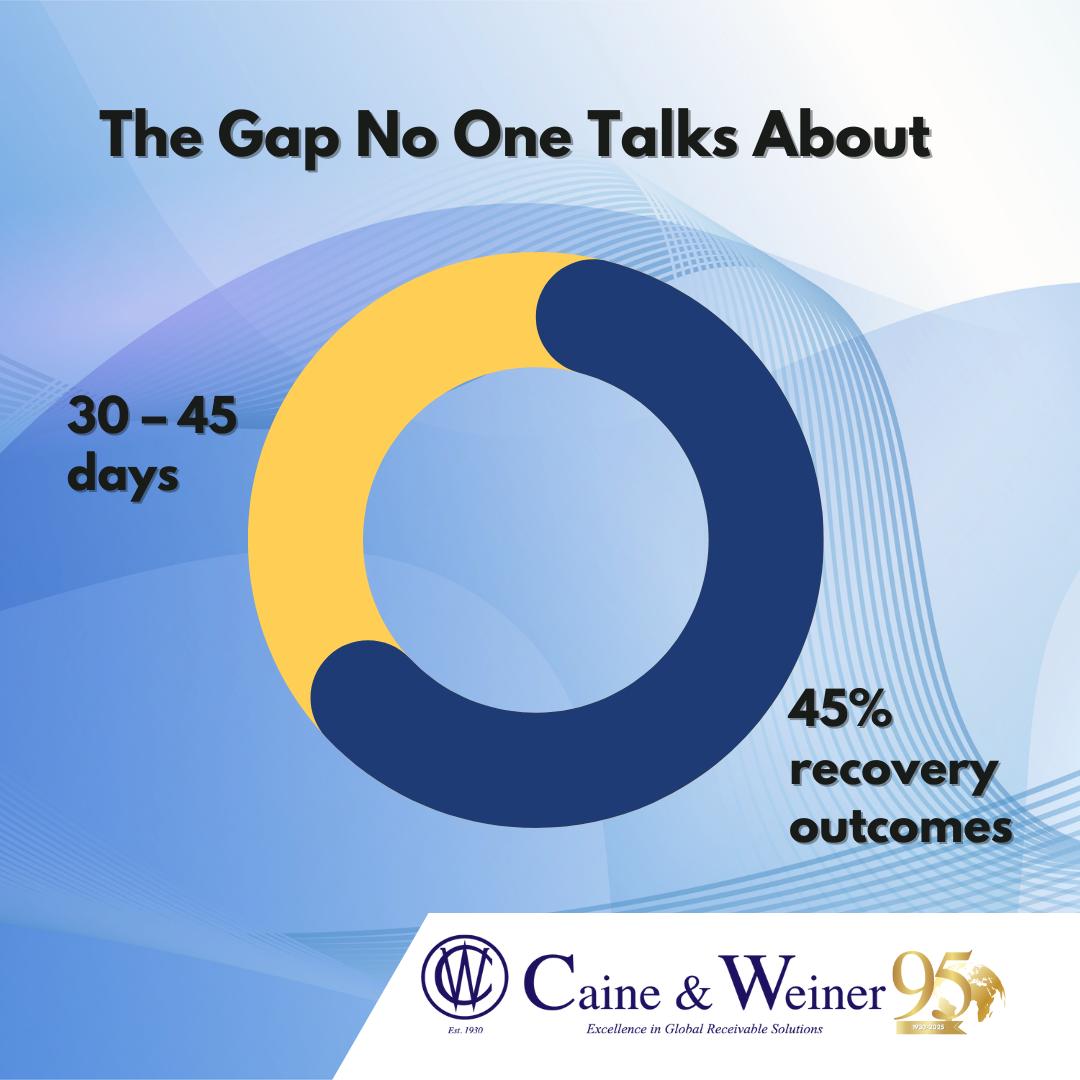

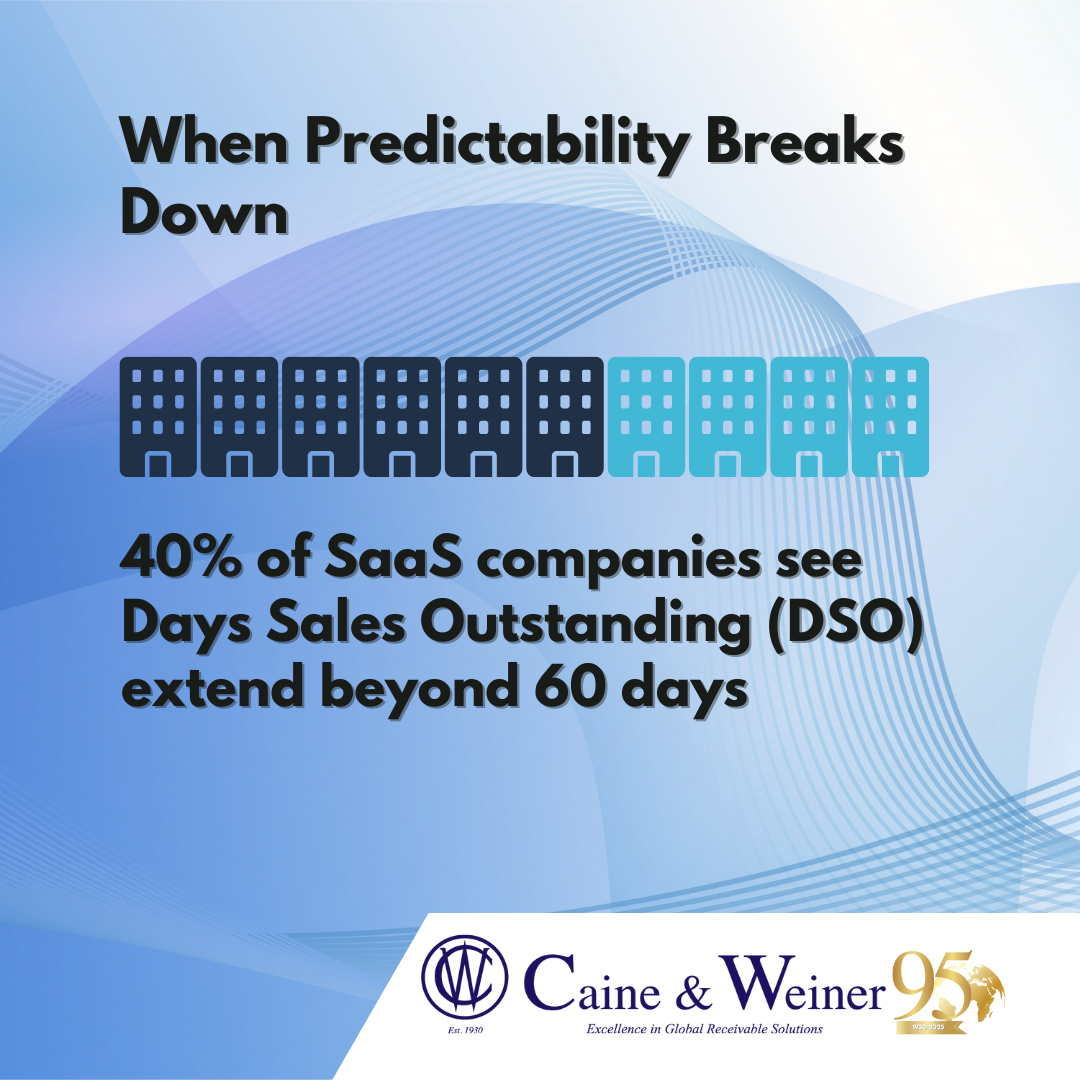

The Gap No One Talks About On paper, everything looks strong. ARR is up. Net retention holds. New logos keep coming in. But behind the scenes, finance teams are watching invoices age—and wondering when booked revenue will actually arrive. This disconnect between ARR and AR is becoming increasingly common. PYMNTS reports that nearly 40% of SaaS firms experience DSO creeping …

When Banks Slow Payments, Liquidity Feels It First

Precision Businesses Can’t Afford Imprecise Cash Flow Banking runs on timing. Interest accrues by the day. Capital ratios are calculated to the decimal. Risk models assume predictable inflows. So when payments slow—even slightly—the impact ripples outward. According to Atradius, 56% of financial institutions reported increased late B2B payments, with average invoice terms stretching beyond 70 days. That shift may look …

Consumer Demand Is Back—Payment Discipline Isn’t

When the Checkout Line Is Full but the Bank Account Isn’t Walk through a shopping district today and it feels like momentum is back. Stores are busy. Online carts are converting. Promotional campaigns are finally paying off after years of consumer hesitation. But inside finance departments, the mood is more cautious. Sales may be rising, but collections tell a different …

SaaS Growth Is Recurring—Late Payments Shouldn’t Be

The Subscription Promise Meets the Cash Reality A SaaS CFO once described their business like a treadmill: steady pace, predictable rhythm, forward motion every month. ARR climbed. Renewals held strong. Dashboards glowed green. But payroll still felt tight. This is the paradox many SaaS companies face today. Subscription revenue is recurring—but cash flow often isn’t. According to the Credit Research …

Why Medical Collections Require a Different Approach Than Commercial AR

Medical collections aren’t transactional—they’re personal. Unlike commercial A/R, healthcare collections involve deeply personal circumstances. Patients are not businesses managing cash flow—they are individuals dealing with health, stress, and uncertainty. Applying standard commercial tactics often leads to poor outcomes and damaged trust. Healthcare collections are also subject to heightened regulation and public scrutiny. Compliance, privacy, and patient protections shape every interaction. …

When Insurance Delays Become Patient Debt

Insurance delays are one of the most common—and frustrating—drivers of patient dissatisfaction. Coverage verification issues, coding errors, payer backlogs, and denied claims often delay reimbursement. According to CMS, claims denial rates range from 5–10%, and a significant portion are preventable. When these delays occur, patient balances are often created unexpectedly. From the patient’s perspective, the process feels unfair. They believe …